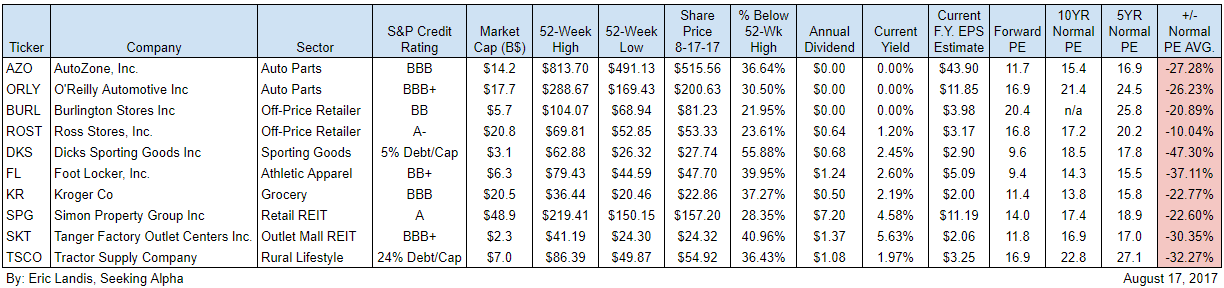

I've identified ten companies that sold off in the last year and are trading at least 20% below 52-week highs.

These companies all have track records of consistent earnings growth, and I think operate in sectors that can resist takeover by Amazon.

Here are the selections:

Showing posts with label DKS. Show all posts

Showing posts with label DKS. Show all posts

Dividend Growth Stocks With Return Promise

Dividend growth stocks generally act as a hedge against economic or political uncertainty as these belong to mature companies, which are less susceptible to large swings in the market while simultaneously offer downside protection with their consistent increase in payouts.

Additionally, these stocks have superior fundamentals that make dividend growth a quality and promising investment for the long term. These include a sustainable business model, a long track of profitability, rising cash flows, good liquidity, strong balance sheet and some value characteristics. Further, a history of strong dividend growth indicates that a future hike is likely, which makes the portfolio safer.

Although these stocks do not necessarily have the highest yields, they have outperformed for a longer period than the broader stock market or any other dividend-paying stock.

Here are the screening results of our latest dividend growth screen of stock that could deliver solid returns for the mid- and long-term:

Additionally, these stocks have superior fundamentals that make dividend growth a quality and promising investment for the long term. These include a sustainable business model, a long track of profitability, rising cash flows, good liquidity, strong balance sheet and some value characteristics. Further, a history of strong dividend growth indicates that a future hike is likely, which makes the portfolio safer.

Although these stocks do not necessarily have the highest yields, they have outperformed for a longer period than the broader stock market or any other dividend-paying stock.

Here are the screening results of our latest dividend growth screen of stock that could deliver solid returns for the mid- and long-term:

14 Stocks Where Inventory Grows Faster Than Sales

Income investors often use the Cash flow as key element of their stock valuation. The figure is calculated as net income plus several positions from the income statement.

- Start with net income.

- Add back non-cash expenses. (Such as depreciation and amortization)

- Adjust for gains and losses on sales on assets.

- Add back losses Subtract out gains Account for changes in all non-cash current assets.

- Account for changes in all current assets and liabilities except notes payable and dividends payable.

| Source: http://www.investopedia.com |

The problem is often the inventory. If sales run flat and inventory grows, there could be a massive risk for investors.

Goldman’s research shows that in a number of sectors inventory growth is outpacing sales growth and is also above normalized levels. Elevated inventory levels could help companies manipulate cash flow figures throughout 2016.

Here are a few stocks, discovered by Goldman Sachs where inventory sales could outpace sales growth...

Subscribe to:

Posts (Atom)