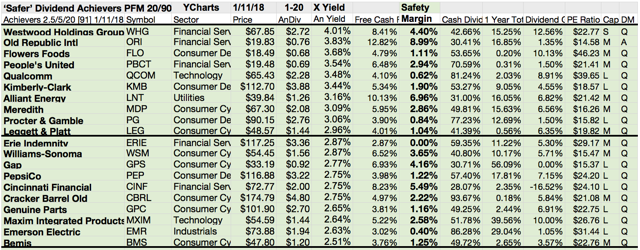

Below is that list resulting from the "safety" check noting positive annual returns and free annual cash flow yield sufficient to cover estimated annual dividend yield.

Showing posts with label FLO. Show all posts

Showing posts with label FLO. Show all posts

3 Solid Dividend Stocks With Buy Rating And Yields Over 3%

It's been a great time to be invested in the stock market recently. The S&P 500 is up 22% during the past 12 months and more than 83% in the past five years.

Even more, with dividends from the S&P 500 automatically reinvested during the past five years, the market index is up more than 100% during this period.

But in a market like this, it's getting increasingly difficult to find solid dividend stocks, particularly dividend stocks with dividend yields over 3%. But there are still some hanging around. Here are a few stocks...

Even more, with dividends from the S&P 500 automatically reinvested during the past five years, the market index is up more than 100% during this period.

But in a market like this, it's getting increasingly difficult to find solid dividend stocks, particularly dividend stocks with dividend yields over 3%. But there are still some hanging around. Here are a few stocks...

6 High-Yielding Dividend Achievers With Good Financial Ratios

I've often said that dividend stocks are the foundation of a great retirement portfolio -- and for good reason. For starters, companies that pay dividends usually have a long history of profitability and a sound long-term outlook.

A business that doesn't have a clear path to growth typically isn't going to pay a dividend. In other words, buying dividend stocks often means buying into high-quality, profitable companies with long histories of success.

Secondly, dividend stocks can help hedge the stock market's inevitable moves lower. Since 1950, the S&P 500 has corrected lower by at least 10% (when rounded to the nearest digit) on 35 occasions.

Owning dividend stocks is a great way to help hedge against these market swoons. As an added bonus, since dividend stocks tend to attract long-term investors, they can sometimes also be far less volatile during corrections.

Lastly, dividend stocks give you the ability to take advantage of compounding over time by reinvesting your payout back into more shares. Doing so allows your ownership in a business to grow, as well as your corresponding payout. Compounding is a tactic some of the smartest money managers use to increase the value of their funds over time.

But some of the best dividend stocks can be found floating well below investors' radars. Attached you will find three high-yield bargain dividend stocks you've probably been overlooking this fall. Every of the results has a dividend yield over 4% and a debt-to-equity below one.

These are the results...

A business that doesn't have a clear path to growth typically isn't going to pay a dividend. In other words, buying dividend stocks often means buying into high-quality, profitable companies with long histories of success.

Secondly, dividend stocks can help hedge the stock market's inevitable moves lower. Since 1950, the S&P 500 has corrected lower by at least 10% (when rounded to the nearest digit) on 35 occasions.

Owning dividend stocks is a great way to help hedge against these market swoons. As an added bonus, since dividend stocks tend to attract long-term investors, they can sometimes also be far less volatile during corrections.

Lastly, dividend stocks give you the ability to take advantage of compounding over time by reinvesting your payout back into more shares. Doing so allows your ownership in a business to grow, as well as your corresponding payout. Compounding is a tactic some of the smartest money managers use to increase the value of their funds over time.

But some of the best dividend stocks can be found floating well below investors' radars. Attached you will find three high-yield bargain dividend stocks you've probably been overlooking this fall. Every of the results has a dividend yield over 4% and a debt-to-equity below one.

These are the results...

29 Undervalued Dividend Stocks

Each company has a dividend yield of at least 3% and the ability to increase payouts.

With dividend stocks hot this year, some market experts are advising investors to be cautious and selective.

Identifying companies with room to raise dividends significantly, rather than focusing on finding the highest yields, might be your best way forward.

So we decided to take a deep dive into the S&P 1500 Composite Index, the S&P 400 Mid-Cap Index MID and the S&P Small-Cap 600 Index in order to identify possible dividend-stock bargains in every sector.

Here are all 29 stocks that passed the screen, broken down by sector:

With dividend stocks hot this year, some market experts are advising investors to be cautious and selective.

Identifying companies with room to raise dividends significantly, rather than focusing on finding the highest yields, might be your best way forward.

So we decided to take a deep dive into the S&P 1500 Composite Index, the S&P 400 Mid-Cap Index MID and the S&P Small-Cap 600 Index in order to identify possible dividend-stock bargains in every sector.

Here are all 29 stocks that passed the screen, broken down by sector:

6 Cheap Dividend Achiever With Yields Over 4%

Dividend stocks can be one of the best ways for individual investors to supplement income or even build wealth over the long term, and finding high quality companies with stocks that yield higher than average rates can accelerate that wealth building portfolio. The trick is finding quality stocks that can keep those payments going over time.

This article tries to discover a number of high quality stocks with big yields for income seeking investors. My focus was on long-term dividend growth and the limit time-line is 10 years. Each of the stocks must have increased dividends by more than 10 years without interruption.

In addition, the forward P/E must be under 15 while yields are over 4%. Exactly 6 stocks fulfilled these similar criteria.

These are the results...

This article tries to discover a number of high quality stocks with big yields for income seeking investors. My focus was on long-term dividend growth and the limit time-line is 10 years. Each of the stocks must have increased dividends by more than 10 years without interruption.

In addition, the forward P/E must be under 15 while yields are over 4%. Exactly 6 stocks fulfilled these similar criteria.

These are the results...

Dividend Growth Stocks Of The Week 21/2016

Dividend growth investing is a popular model followed by the investing community to build assets.

Companies which not only pay dividends, but raise them year after year have been shown to perform better overall for investor returns.

Following companies announced dividend increases this week. These are the dividend grower from the past week... If you like them to receive in the future, just subscribe to my free newsletter.

Companies which not only pay dividends, but raise them year after year have been shown to perform better overall for investor returns.

Following companies announced dividend increases this week. These are the dividend grower from the past week... If you like them to receive in the future, just subscribe to my free newsletter.

Here are the latest dividend growth stocks compiled...

20 Attactive Low Volatility Consumer Goods Stocks

When I'm thinking about how to arrange a portfolio, I think there is a uniquely human aspect to the process.

The ideal dividend portfolio depends on the risk factors an investor feels comfortable accepting.

After the year is over, any investor can easily see which companies delivered the best returns, but when the period is starting, the goal is for an investor is to be carrying a portfolio that meets their individual objectives.

This piece is going to focus on the dividend champions of the consumer staples sector.

Given the relatively high valuation of the market, I believe it is more rational to focus investments on sectors with less volatility in their ability to generate sales.

Attached you will find a compilation of stocks from the consumer goods sector with solid yields, modest growth predictions and low beta ratios.

These are my favorites...

The ideal dividend portfolio depends on the risk factors an investor feels comfortable accepting.

After the year is over, any investor can easily see which companies delivered the best returns, but when the period is starting, the goal is for an investor is to be carrying a portfolio that meets their individual objectives.

This piece is going to focus on the dividend champions of the consumer staples sector.

Given the relatively high valuation of the market, I believe it is more rational to focus investments on sectors with less volatility in their ability to generate sales.

Attached you will find a compilation of stocks from the consumer goods sector with solid yields, modest growth predictions and low beta ratios.

These are my favorites...

20 Best Yielding Profitable Growing Buyback Kings And My 8 Favorite Stocks

Today's screen discovers stocks

with recent buyback announcements. I've compiled those stocks with a recent

buyback program announcement.

Those buybacks are paid from a

profitable operating business that is growing, not only in the past but should

also go forward in the near future.

A consequence is

that each of the attached stocks has a positive 5 years past sales performance,

positive return on assets and positive expected 5 year EPS growth predictions

as well.

Attached you will find the 20

best yielding results.

These are my personal favorites...

These are my personal favorites...

9 Must-Have Stocks That Should Become Bigger During The Next Recession

When the stock market drops in value, high quality dividend stocks that are less sensitive to the broader economy tend to significantly outperform.

When the stock market drops in value, high quality dividend stocks that are less sensitive to the broader economy tend to significantly outperform.

This means that your performance will also suffer but less than the overall market.

A second issue is that large caps with a big footprint in its industry and healthy financial ratios will perform better in stormy times. Smaller and riskier positioned competitors will be thrown out of the market.

That's why most recession will make market leaders often bigger and stronger.

Companies that consistently raise their dividends tend to be very healthy businesses with long-lasting competitive advantages.

Dividend investors like to look for these stocks in the dividend aristocrats list and the dividend kings list, which contain high quality dividend stocks that collectively outperformed during the last recession and have raised their payouts for at least 25 and 50 consecutive years, respectively.

Attached you will find 9 of the currently most attractive stocks which could grow bigger during a market downturn or a recession.

Here are the ideas...

9 Stocks That Might Be Interesting For Warren Buffett In Q1/2016

What should investors do when fear rises and the stock market falls?

The answer is quiet simple:

Invest in high quality dividend paying businesses at reduced prices. Warren Buffett knows this well. It is one of the ways he has grown his fortune to over $60 billion.

Warren Buffett is a great idol and many of us have looked at his portfolio in order to get new ideas and to learn from his investment approach.

Attached you will find a selection of 10 stocks that might be interesting for Warren after the latest market correction.

Maybe you might agree with me or not. The results show some of the best high quality dividend stocks you can catch on the market.

It does not mean that those promise a high return but they could offer more value and stability to your portfolio.

Here are the results I'm talking about...

The answer is quiet simple:

Invest in high quality dividend paying businesses at reduced prices. Warren Buffett knows this well. It is one of the ways he has grown his fortune to over $60 billion.

Warren Buffett is a great idol and many of us have looked at his portfolio in order to get new ideas and to learn from his investment approach.

Attached you will find a selection of 10 stocks that might be interesting for Warren after the latest market correction.

Maybe you might agree with me or not. The results show some of the best high quality dividend stocks you can catch on the market.

It does not mean that those promise a high return but they could offer more value and stability to your portfolio.

Here are the results I'm talking about...

10 High-Quality Dividend Stocks Each Long-Term Investor Should Have On Their Radar

High-quality dividend stocks are some of the best investments long-term investors can make.

These are some of the top blue-chip stocks because they play major roles in the economy, dominate their markets and have proven track records of rewarding shareholders with higher dividend payments over long periods of time.

As long-term dividend investors, we look for durable businesses that generate consistent free cash flow, maintain healthy balance sheets, operate in slow-changing markets and have numerous opportunities for long-term earnings and dividend growth.

Today you will find in the attached list 10 stocks that are qualified as long-term investments. Each of the stocks pay dividends, have grown them over years and large caps.

10 High-Quality Dividend Stocks On Your Radar Are...

As long-term dividend investors, we look for durable businesses that generate consistent free cash flow, maintain healthy balance sheets, operate in slow-changing markets and have numerous opportunities for long-term earnings and dividend growth.

Today you will find in the attached list 10 stocks that are qualified as long-term investments. Each of the stocks pay dividends, have grown them over years and large caps.

10 High-Quality Dividend Stocks On Your Radar Are...

Top Dividend Grower Of The Week

Today I like to highlight those

stocks with dividend growth in the past week. In total, 12 companies raised

dividends of which four have a yield of more than 3 percent.

The biggest stocks

on the attached list were Caterpillar, Target, FedEx and CR Bard, each with a

market capitalization over 10 billion.

Here are the top

results:

8 Top Stocks With Recent Dividend Growth Or Stock Buyback Announcements

Below are the latest dividend growers and stocks with a fresh buyback announcement. I hope you have some fun by reading and discovering new stock ideas.

Below are the latest dividend growers and stocks with a fresh buyback announcement. I hope you have some fun by reading and discovering new stock ideas.18 companies have raised their dividend payments during the past week. The biggest stocks are Merck, Aetna and Becton, Dickinson and Company. You can discover more results at the end of this post.

In addition, 13 companies announced a new or refreshed share buyback program. The biggest stocks are ACE Limited, Westlake Chemical and The Vasper Corporation as well. The full list of buyback companies is also attached.

Please donate if you find some values in my screens. Thank you so much for reading and supporting my work.

These are some of the biggest results from the past week:

50 Stocks With Fastest Dividend Growth In August 2013

Stocks with highest dividend

growth originally published at Dividend Yield – Stock, Capital, Investment.

Let’s take a look at to the

stocks with the fastest dividend growth during August 2013. There were a huge number

of stocks which announced to pay a higher dividend in the future. Each week, I publish

lists of all these stocks on my blog.

Today would like to give

you an update of the 50 fastest dividend growers from the recent month. Below

the results are again some pretty good stocks with very good growth rates. The

average dividend growth of the 50 best stocks amounts to 36.19 percent.

Three of the 50 dividend growers have a double-digit dividend yield and four a high-yield over 5

percent. 8 percent of the results have a buy or better rating.

These 29 Stocks Hiked Their Dividend Payments Last Week

Stocks with dividend hikes from last week originally

published at long-term-investments.blogspot.com.

I strongly believe that dividend growth investing will deliver good returns. As

of now, I quadrupled my net worth by trading dividend growth stocks and boosted

my passive income to a five-figure annual salary.

It’s great to see how everybody can build a portfolio of

stocks that is growing and becomes better over the time. It feels like you are a

real investor. Not playing with money or spending it. You invest it. You watch your

assets and observe how your portfolio companies develop over the time. Some stocks

will disappoint you and fail for sure. But if you have a good diversification of

at least 50 shares or more, your average return will be great.

However, back to the current dividend growth stocks from

last week. On my blog long-term-investments.blogspot.com, I publish on a

regular basis lists of the latest dividend growers.

Last week, 29 companies announced a higher dividend. I’ve

published all stocks with dividend growth from the recent week in the attached

dividend list for you. You can also find a compilation of price and yield ratios

there. In average, stocks from the list of the latest dividend growth stocks

have increased their dividend payments by 17.03 percent.

Four of the results have a high yield of more than

five percent and three yielding over 10%. Analysts and brokerage firms

recommend 14 of the latest dividend growth stocks.

Consumer Goods Stocks With Highest YTD Performance And Cheap Price Ratios

Consumer goods dividend stocks with highest year-to-date

performance originally published at long-term-investments.blogspot.com. Consumer dividend stocks

are my favorite investments when I think about how to make money on the stock market.

I prefer those stocks because of the low cyclic they have. Most of them

generate stable cash flows and pay good dividends as well as buy own shares

back. Not to forget: They still have possibilities to grow in a developed

market.

Today I would close my monthly screening serial

of the best performing dividend stocks from several sectors with the consumer

goods sector. These are the latest articles of the serial:

The 20 best performing dividend stocks from the consumer sector with a

market capitalization over USD 200 million gained from 44.89 percent to 112.16

percent this year. The best performing non dividend paying stock is more an

industrial stock than a consumer company. It’s the electric vehicle producer

Tesla. The company’s stock price quadrupled since the start of the year. The

top dividend payer is the multi-marketing level company Nu Skin Enterprises.

Despite the strong stock price increase, 16 of

the top 20 performing sector dividend stocks still have a buy or better rating.

Ex-Dividend Stocks: Best Dividend Paying Shares On June 03, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks June 03,

2013. In total, 28 stocks and

preferred shares go ex dividend - of which 10 yield more than 3 percent. The

average yield amounts to 3.12%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

France

Telecom

|

27.76B

|

27.58

|

0.88

|

0.49

|

14.31%

|

|

|

Enerplus

Corporation

|

3.14B

|

-

|

1.01

|

2.72

|

6.82%

|

|

|

Cedar

Fair, L.P.

|

2.33B

|

23.28

|

14.65

|

2.18

|

5.97%

|

|

|

Ventas,

Inc.

|

21.34B

|

57.31

|

2.33

|

8.20

|

3.68%

|

|

|

Hancock

Holding Co.

|

2.45B

|

13.77

|

0.99

|

3.25

|

3.32%

|

|

|

Avery

Dennison Corporation

|

4.38B

|

23.79

|

2.80

|

0.72

|

2.64%

|

|

|

Stanley

Black & Decker, Inc.

|

12.99B

|

31.22

|

1.94

|

1.27

|

2.44%

|

|

|

QUALCOMM

Incorporated

|

110.89B

|

18.08

|

2.95

|

5.12

|

2.18%

|

|

|

Brown-Forman

Corporation

|

15.15B

|

26.27

|

9.97

|

5.43

|

1.97%

|

|

|

Flowers

Foods, Inc.

|

4.65B

|

22.27

|

4.92

|

1.42

|

1.90%

|

|

|

Nielsen

Holdings N.V.

|

12.67B

|

43.45

|

2.45

|

2.24

|

1.89%

|

|

|

Schlumberger

Limited

|

99.46B

|

18.52

|

2.79

|

2.31

|

1.67%

|

|

|

Everest

Re Group Ltd.

|

6.48B

|

7.41

|

0.95

|

1.29

|

1.48%

|

|

|

HSN,

Inc.

|

3.04B

|

23.03

|

6.47

|

0.92

|

1.27%

|

|

|

Halliburton

Company

|

39.73B

|

20.50

|

2.53

|

1.39

|

1.17%

|

|

|

Southwest

Airlines Co.

|

10.31B

|

27.98

|

1.50

|

0.60

|

1.12%

|

|

|

Compuware

Corporation

|

2.41B

|

34.48

|

2.30

|

2.49

|

1.10%

|

|

|

Itau Unibanco Holding S.A.

|

76.58B

|

10.96

|

1.84

|

2.62

|

0.59%

|

17 Highest Dividend Paying Processed & Packaged Goods Stocks

The

highest yielding processed and packaged goods stocks originally published at

"long-term-investments.blogspot.com". One of my favorite

industries within the consumer goods sector is the processed and packaged goods

industry. Only 35 companies have a relationship to the industry and 17 of them

pay dividends.

I love the industry because of the high number of low beta stocks. Foods and consumer goods are daily consumption products with essential functions. Consumers don’t stop washing or cooking if the economy is going down. Sure if they lose their job they need to look for cheaper products or scout for less services and quality but they don’t stop consuming. That’s also the reason why I love the processed and packaged goods industry. Car purchases will be deferred but toilet paper and deodorant buys not in the same way.

Linked is a small list of the highest dividend paying processed and packaged goods stocks. 12 of them have a current buy or better recommendation.

I love the industry because of the high number of low beta stocks. Foods and consumer goods are daily consumption products with essential functions. Consumers don’t stop washing or cooking if the economy is going down. Sure if they lose their job they need to look for cheaper products or scout for less services and quality but they don’t stop consuming. That’s also the reason why I love the processed and packaged goods industry. Car purchases will be deferred but toilet paper and deodorant buys not in the same way.

Linked is a small list of the highest dividend paying processed and packaged goods stocks. 12 of them have a current buy or better recommendation.

Ex-Dividend Stocks: Best Dividend Paying Shares On February 27, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors should

have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks February

27, 2013. In total, 91 stocks and

preferred shares go ex dividend - of which 32 yield more than 3 percent. The

average yield amounts to 4.03%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

TransAlta

Corp.

|

4.07B

|

-

|

1.36

|

1.81

|

7.25%

|

|

Lorillard,

Inc.

|

6.10B

|

14.52

|

-

|

0.92

|

5.39%

|

|

Lockheed

Martin Corporation

|

28.44B

|

10.51

|

732.33

|

0.60

|

5.23%

|

|

Realty

Income Corp.

|

7.94B

|

58.37

|

2.45

|

16.69

|

4.89%

|

|

Northeast

Utilities

|

12.88B

|

21.48

|

1.37

|

2.05

|

3.58%

|

|

Brookfield

Properties Corporation

|

8.39B

|

7.45

|

0.73

|

3.68

|

3.37%

|

|

NextEra

Energy, Inc.

|

30.55B

|

15.73

|

1.90

|

2.14

|

3.32%

|

|

McDonald's

Corp.

|

96.52B

|

17.94

|

6.95

|

3.50

|

3.20%

|

|

Cullen/Frost

Bankers, Inc.

|

3.69B

|

15.59

|

1.53

|

5.85

|

3.20%

|

|

SLM

Corporation

|

8.67B

|

9.73

|

1.68

|

1.42

|

3.20%

|

|

The

Wendy's Company

|

2.13B

|

-

|

1.08

|

0.85

|

2.94%

|

|

L-3

Communications Holdings

|

7.08B

|

9.41

|

1.31

|

0.54

|

2.92%

|

|

Pepsico,

Inc.

|

116.00B

|

19.18

|

5.21

|

1.77

|

2.86%

|

|

Compass

Minerals International

|

2.49B

|

28.16

|

4.93

|

2.65

|

2.64%

|

|

GATX

Corp.

|

2.30B

|

16.98

|

1.85

|

1.85

|

2.53%

|

|

Sealed

Air Corporation

|

4.10B

|

-

|

2.41

|

0.53

|

2.47%

|

|

CH

Robinson Worldwide Inc.

|

9.15B

|

15.47

|

6.08

|

0.81

|

2.47%

|

|

Weyerhaeuser

Co.

|

15.66B

|

40.54

|

3.84

|

2.22

|

2.36%

|

|

Flowers

Foods, Inc.

|

3.84B

|

3.99

|

4.48

|

1.26

|

2.30%

|

|

Associated

Banc-Corp

|

2.38B

|

14.03

|

0.82

|

3.31

|

2.26%

|

Subscribe to:

Posts (Atom)