If you want to get a high dividend,

not a large of 5 percent or more, I'm talking about yields far over 10% yearly,

you need to take big risks.

If you want to get a high dividend,

not a large of 5 percent or more, I'm talking about yields far over 10% yearly,

you need to take big risks.

Normally, a 10% or

more yields is normally a tell-tale sign that a dividend payout is

unsustainable. A stock that has a dividend yield in the double digits can be

incredibly tempting to an investor. The problem with dividend stocks is that so

many of those high yields are eventually cut because the businesses can't

continue to support the payout.

That isn't always

the case, though. Some companies have monstrously high yields that aren't at

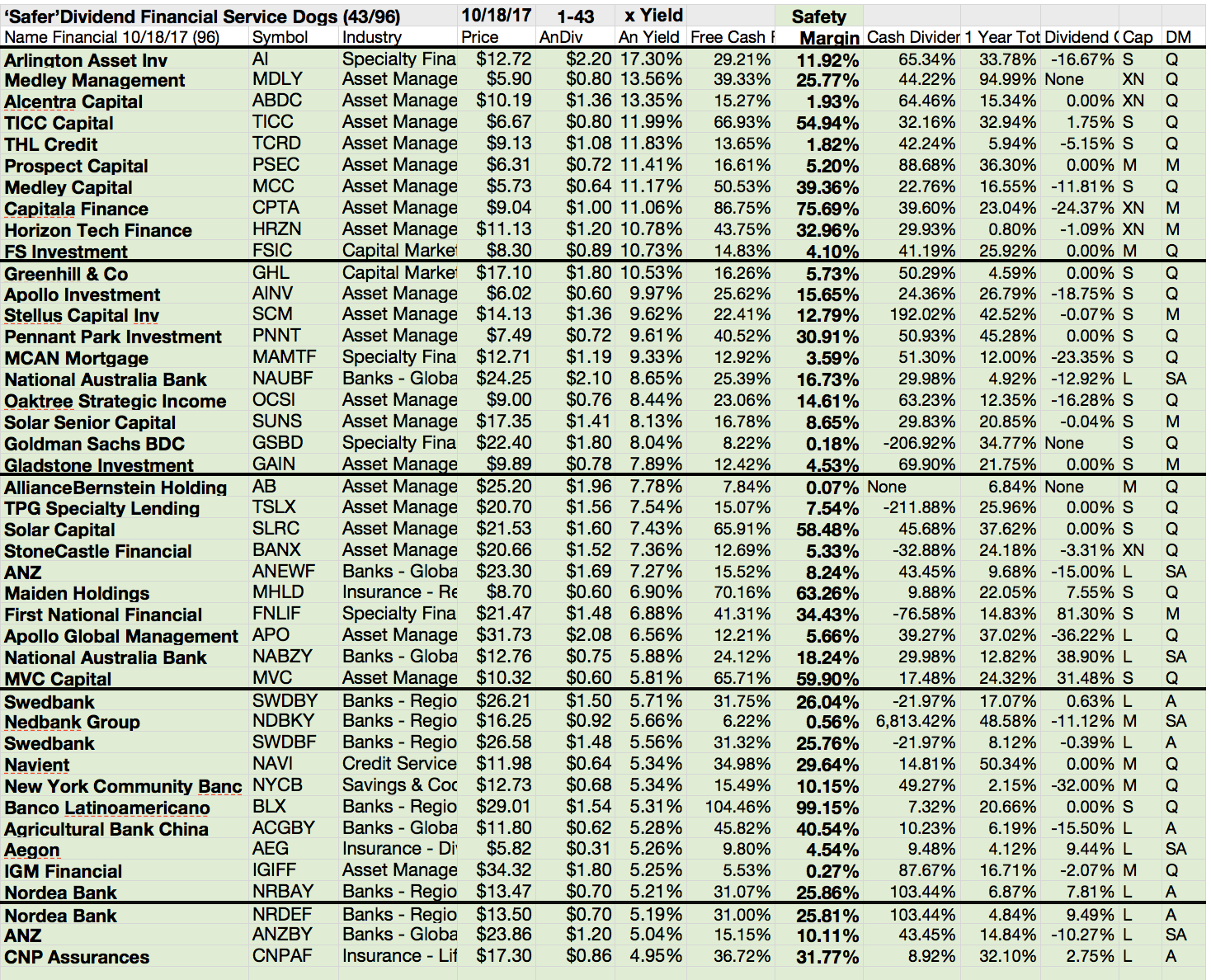

much risk of being cut. Attached I've tried to compile a few stocks with a

double-digit yields that have fundamental strength to keep paying its

investors.

On the market are

276 companies with a current dividend yield over 10%. Mostly high leveraged

companies from the energy and real estate sector are under them.

I've put my eyes

on those stocks with a market cap over 2 billion and a debt to equity under 1.

Exactly 15 companies have such a good ratio.

Here are the

results…