Showing posts with label HLS. Show all posts

Showing posts with label HLS. Show all posts

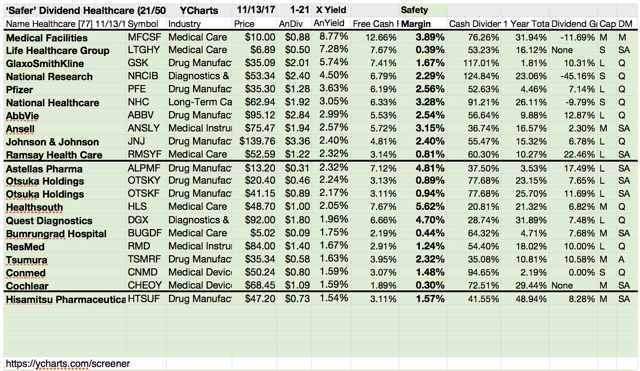

21 Safe Healthcare Dividend Stocks

You see grouped below the green tinted list of 21 that passed the Healthcare dog "safer" check with positive past-year returns and cash flow yield sufficient to cover their anticipated annual dividend yield. The margin of cash excess is shown in the bold face "Safety Margin"column.

20 Cheapest Large Cap Healthcare Dividend Stocks

The stock market offers opportunities every day, but healthcare is easily the sector benefiting most from the trend of aging demographics in the U.S. and throughout the developed world.

This helps explain how over the past decade, the Global Healthcare Sector has outperformed the benchmark S&P 500 by more than 20%.

Looking for cheap stocks that pay dividends? These healthcare leaders are riding the aging demographic trends to profit town and deserve your attention.

The first thing that comes to mind, when determining whether a stock is overvalued or not, is its price-to-earnings (P/E) multiple. We hereby shortlist healthcare stocks with forward P/E ratio trading below 15x. Standard criterion holds that, anything under 15x will be dirt cheap.

Because of the high market valuation, we can say today that high-quality dividend stocks with a P/E under 20 are cheap, compared to bond yields.

Attached you will get a list of the cheapest healthcare dividend stocks by forward P/E. I've excluded all stocks with a market capitalization under 2 billion. Each of the results has a forward P/E under 15 which corresponds with an earnings yield over 6.6%.

These are the 20 cheapest healthcare dividend stocks....

This helps explain how over the past decade, the Global Healthcare Sector has outperformed the benchmark S&P 500 by more than 20%.

Looking for cheap stocks that pay dividends? These healthcare leaders are riding the aging demographic trends to profit town and deserve your attention.

The first thing that comes to mind, when determining whether a stock is overvalued or not, is its price-to-earnings (P/E) multiple. We hereby shortlist healthcare stocks with forward P/E ratio trading below 15x. Standard criterion holds that, anything under 15x will be dirt cheap.

Because of the high market valuation, we can say today that high-quality dividend stocks with a P/E under 20 are cheap, compared to bond yields.

Attached you will get a list of the cheapest healthcare dividend stocks by forward P/E. I've excluded all stocks with a market capitalization under 2 billion. Each of the results has a forward P/E under 15 which corresponds with an earnings yield over 6.6%.

These are the 20 cheapest healthcare dividend stocks....

26.25% Annual Return With Lobbying Stocks? Here is how it works...

I

found an interesting portfolio investing idea: Invest into stocks that spend a

huge amount of money to support political campaigns’.

It's no wonder that corporations have a huge interest in spending money for politics: Each dollar should create a return of 220 bucks in the future. That's a pretty good investment in my view.

It's no wonder that corporations have a huge interest in spending money for politics: Each dollar should create a return of 220 bucks in the future. That's a pretty good investment in my view.

I'm no social guy and have no thoughts in my mind how

governments work but stocks that have spend huge amounts for lobbying as

a percent of total assets, have performed very well in the past.

Stocks that lobby Washington beat the street by shocking 11 percent yearly!

Stocks that lobby Washington beat the street by shocking 11 percent yearly!

Since 2009 a compilation of lobbing stocks generated

an annual return of 26.25 percent while the Sharpe Ratio of the combined

portfolio reached a high value of 0.88.

Look at my attached stock list. Hope you get some new

ideas. I still introduce many investing ideas and dividend growing stocks on my

blog.

17 High Momentum Healthcare Dividend Stocks

Healthcare

dividend stocks with highest beta ratios originally published at long-term-investments.blogspot.com. You know that I am a

conservative investor and try to minimize my risk.

This strategy is necessary if you have a larger amount of money to take care of or you begin to cry when you lose 10 percent on your book value. The second disadvantage is that you lose performance in a strong up moving market.

Since 2009, there were nearly no bigger corrections at the market but with low beta and safe haven stocks, your performance would be only half of the return from the markets. What you need to get a push for your portfolio is a high beta stock. I don’t recommend buying them because it’s a definitely riskier strategy and nobody knows when the market turns into a bearish mood.

However, let’s take a look at the high fly momentum stocks from the healthcare sector. Those are stocks with the highest beta ratio from the sector. They have a beta between 1 and 2. With focus on the dividend paying stocks, only 17 stocks from the healthcare sector pay a dividend and being correlated with the market by a factor of up to 2.

One High-Yield is below the results and 16 have a current buy or better rating by brokerage firms.

This strategy is necessary if you have a larger amount of money to take care of or you begin to cry when you lose 10 percent on your book value. The second disadvantage is that you lose performance in a strong up moving market.

Since 2009, there were nearly no bigger corrections at the market but with low beta and safe haven stocks, your performance would be only half of the return from the markets. What you need to get a push for your portfolio is a high beta stock. I don’t recommend buying them because it’s a definitely riskier strategy and nobody knows when the market turns into a bearish mood.

However, let’s take a look at the high fly momentum stocks from the healthcare sector. Those are stocks with the highest beta ratio from the sector. They have a beta between 1 and 2. With focus on the dividend paying stocks, only 17 stocks from the healthcare sector pay a dividend and being correlated with the market by a factor of up to 2.

One High-Yield is below the results and 16 have a current buy or better rating by brokerage firms.

Subscribe to:

Posts (Atom)