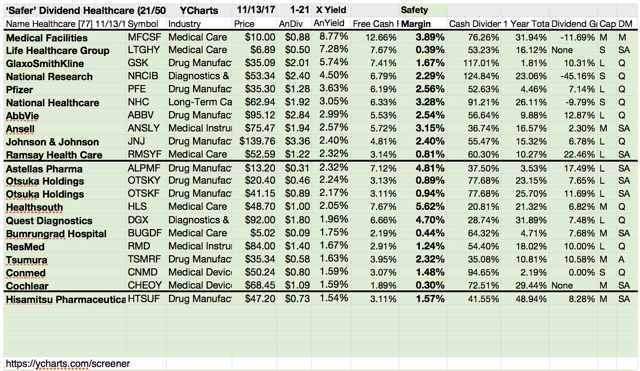

21 Safe Healthcare Dividend Stocks

You see grouped below the green tinted list of 21 that passed the Healthcare dog "safer" check with positive past-year returns and cash flow yield sufficient to cover their anticipated annual dividend yield. The margin of cash excess is shown in the bold face "Safety Margin"column.

Dividend Growth Stocks Of The Recent Week, Sorted By Growth

| Company | Ticker | New Yield in % | Dividend Growth | New Dividend | Old Dividend | Payment Period |

| Cheniere Energy Partners | CQH | 6.71 | 2150.00% | 0.45 | 0.02 | Quarterly |

| NACCO Industries Cl A | NC | 1.54 | 165.06% | 0.165 | 0.06225 | Quarterly |

| Air Lease | AL | 0.93 | 33.33% | 0.1 | 0.075 | Quarterly |

| Ares Management | ARES | 8.72 | 32.26% | 0.41 | 0.31 | Quarterly |

| DR Horton | DHI | 1.09 | 25.00% | 0.125 | 0.1 | Quarterly |

| Inter Parfums | IPAR | 1.94 | 23.53% | 0.21 | 0.17 | Quarterly |

| Alon USA Partners | ALDW | 12.45 | 22.86% | 0.43 | 0.35 | Quarterly |

| BorgWarner | BWA | 1.31 | 21.43% | 0.17 | 0.14 | Quarterly |

| Starbucks | SBUX | 2.12 | 20.00% | 0.3 | 0.25 | Quarterly |

| Huntington Ingalls Inds | HII | 1.14 | 20.00% | 0.72 | 0.6 | Quarterly |

| Fidelity D&D Bancorp | FDBC | 2.51 | 16.13% | 0.24 | 0.20667 | Quarterly |

| Snap-On | SNA | 2.07 | 15.49% | 0.82 | 0.71 | Quarterly |

| Hewlett Packard Ent | HPE | 2.19 | 15.38% | 0.075 | 0.065 | Quarterly |

| Nelnet A | NNI | 1.24 | 14.29% | 0.16 | 0.14 | Quarterly |

| Core-Mark Holding | CORE | 1.38 | 11.11% | 0.1 | 0.09 | Quarterly |

| Automatic Data | ADP | 2.24 | 10.53% | 0.63 | 0.57 | Quarterly |

| LCI Industries | LCII | 1.90 | 10.00% | 0.55 | 0.50 | Quarterly |

| Six Flags Entertainment | SIX | 4.3 | 9.38% | 0.7 | 0.64 | Quarterly |

| Primoris Services | PRIM | 0.86 | 9.09% | 0.06 | 0.06 | Quarterly |

| Aaron?s Inc | AAN | 0.34 | 9.09% | 0.03 | 0.0275 | Quarterly |

| National Bankshares | NKSH | 2.79 | 8.93% | 0.61 | 0.56 | SemiAnnual |

| Atmos Energy | ATO | 2.16 | 7.78% | 0.485 | 0.45 | Quarterly |

| Aircastle Ltd | AYR | 4.7 | 7.69% | 0.28 | 0.26 | Quarterly |

| Natl Storage Affiliates | NSA | 4.33 | 7.69% | 0.28 | 0.26 | Quarterly |

| NVIDIA | NVDA | 0.28 | 7.14% | 0.15 | 0.14 | Quarterly |

| DTE Energy | DTE | 3.16 | 6.97% | 0.8825 | 0.825 | Quarterly |

| Black Hills | BKH | 3.18 | 6.74% | 0.475 | 0.445 | Quarterly |

| MainSource Fincl Group | MSFG | 2.02 | 5.88% | 0.18 | 0.17 | Quarterly |

| Jones Lang LaSalle | JLL | 0.52 | 5.71% | 0.37 | 0.35 | SemiAnnual |

| Arbor Realty Trust | ABR | 8.93 | 5.56% | 0.19 | 0.18 | Quarterly |

| Ladder Capital Cl A | LADR | 9.22 | 5.00% | 0.315 | 0.3 | Quarterly |

| EMC Insurance Group | EMCI | 3.10 | 4.76% | 0.22 | 0.21 | Quarterly |

| Group 1 Automotive | GPI | 1.26 | 4.17% | 0.25 | 0.24 | Quarterly |

| Sabine Royalty Tr UBI | SBR | 4.36 | 4.14% | 0.15715 | 0.1509 | Monthly |

| AmerisourceBergen | ABC | 2.03 | 4.11% | 0.38 | 0.365 | Quarterly |

| Easterly Govt Properties | DEA | 5.06 | 4.00% | 0.26 | 0.25 | Quarterly |

| Acadia Realty Trust | AKR | 3.69 | 3.85% | 0.27 | 0.26 | Quarterly |

| STRATS Dom Res Ser 05-06 | GJP | 3.44 | 3.34% | 0.0637 | 0.06164 | Monthly |

| Solar Capital | SLRC | 7.53 | 2.50% | 0.41 | 0.40 | Quarterly |

| Global Water Resources | GWRS | 2.9 | 2.47% | 0.02363 | 0.02306 | Monthly |

| 4.65% Fltg. Rate STRATS | GJO | 2.13 | 2.14% | 0.03873 | 0.03792 | Monthly |

| Universal Corp | UVV | 4.01 | 1.85% | 0.55 | 0.54 | Quarterly |

| Sanchez Midstream Ptrs | SNMP | 14.2 | 1.51% | 0.4508 | 0.4441 | Quarterly |

| Lexington Realty Trust | LXP | 6.85 | 1.43% | 0.1775 | 0.175 | Quarterly |

| Emerson Electric | EMR | 3.1 | 1.04% | 0.485 | 0.48 | Quarterly |

| Pattern Energy Group | PEGI | 8.07 | 0.48% | 0.422 | 0.42 | Quarterly |

| Microchip Technology | MCHP | 1.59 | 0.14% | 0.36 | 0.36 | Quarterly |

The Kraft Heinz Company (KHC) Pay $0.63 Dividend - Here are Essential Fundamentals

Important news for shareholders and potential investors in The Kraft Heinz Company (NASDAQ:KHC):

The dividend payment of $0.63 per share will be distributed into shareholder on 15 December 2017, and the stock will begin trading ex-dividend at an earlier date, 16 November 2017.

Is this future income a persuasive enough catalyst for investors to think about KHC as an investment today?

The dividend payment of $0.63 per share will be distributed into shareholder on 15 December 2017, and the stock will begin trading ex-dividend at an earlier date, 16 November 2017.

Is this future income a persuasive enough catalyst for investors to think about KHC as an investment today?

Labels:

KHC

Subscribe to:

Posts (Atom)