|

| Source: Seeking Alpha |

Showing posts with label MITT. Show all posts

Showing posts with label MITT. Show all posts

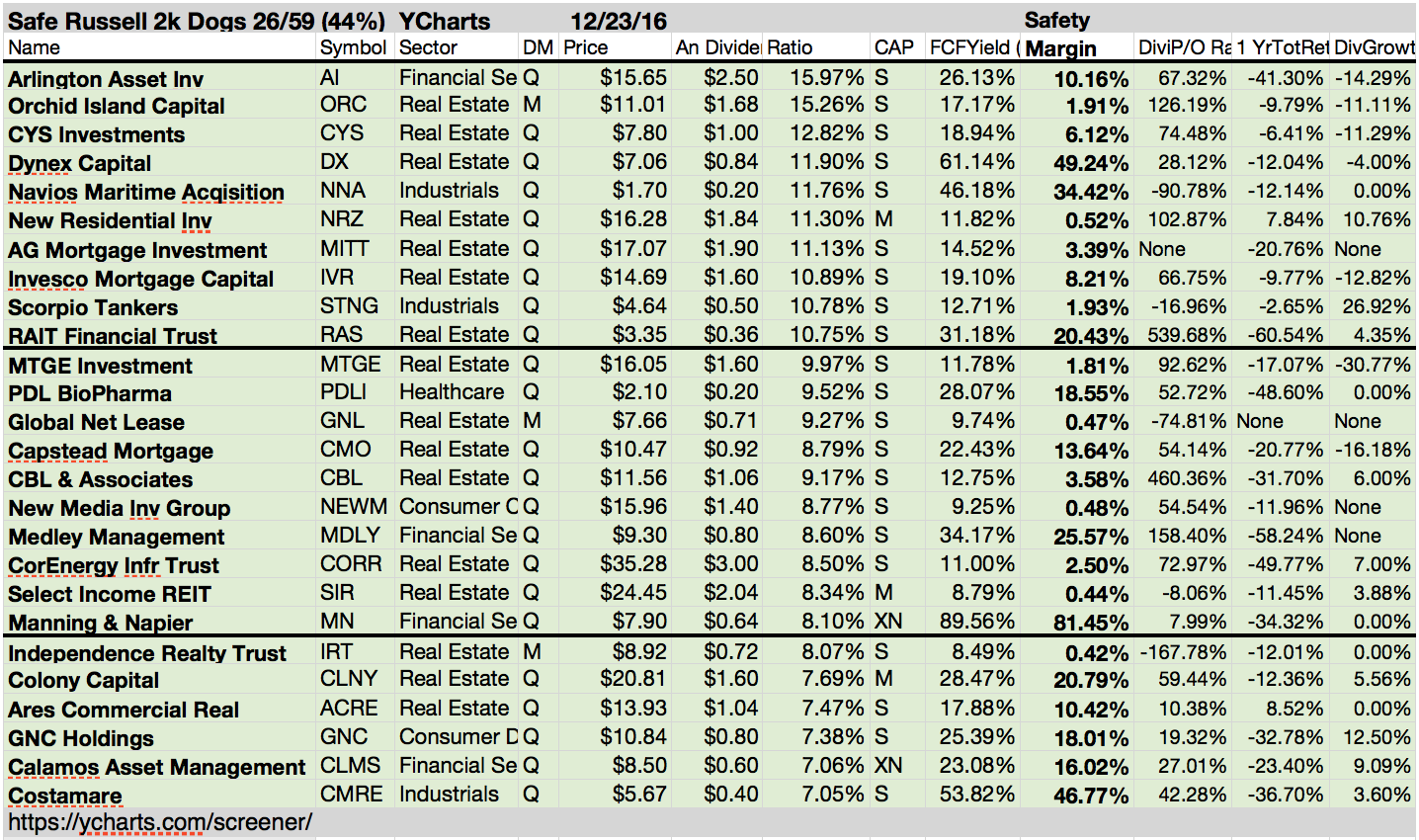

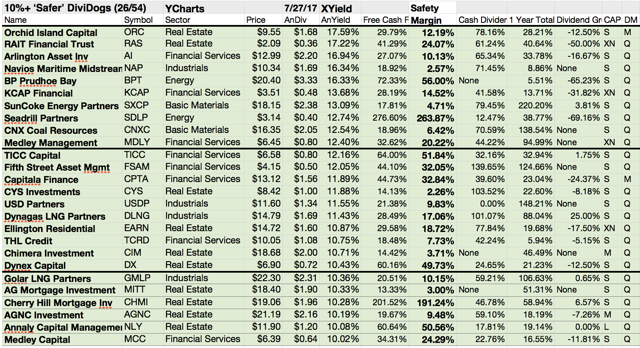

Russell 2000 Dogs With Hard Safe Yields

Dividend investors face a constant battle of choosing between dividend yield and sustainability.

Generally speaking, low yields are often sustainable but may be undesirable for investors looking to pad their portfolio with dividend income or reinvestment opportunities.

On the other end of the spectrum, high yields (let's say 5% and higher) are extremely attractive for income-seeking investors, but they're also often far more dangerous than lower yields due to a possible lack of sustainability.

Remember that dividend yields are a function of payout divided by share price, and if a stock's share price has been tumbling, its yield will rise. Thus, dividend investors have to be diligent to ensure that a yield isn't inflated solely because a company's business model is in trouble.

Attached you will find a list of stocks from the Russell 2000 with high yields. Most of them have free cashflow yield exceeding the dividend yield.

Here are the results...

Generally speaking, low yields are often sustainable but may be undesirable for investors looking to pad their portfolio with dividend income or reinvestment opportunities.

On the other end of the spectrum, high yields (let's say 5% and higher) are extremely attractive for income-seeking investors, but they're also often far more dangerous than lower yields due to a possible lack of sustainability.

Remember that dividend yields are a function of payout divided by share price, and if a stock's share price has been tumbling, its yield will rise. Thus, dividend investors have to be diligent to ensure that a yield isn't inflated solely because a company's business model is in trouble.

Attached you will find a list of stocks from the Russell 2000 with high yields. Most of them have free cashflow yield exceeding the dividend yield.

Here are the results...

Ex-Dividend Stocks: Best Dividend Paying Shares On September 17, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

In total, 39 stocks,

preferred shares or funds go ex dividend - of which 11 yield more than 3

percent. The average yield amounts to 6.69%. Here is a full list of all stocks with ex-dividend

date within the current week.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

|

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

|

AG Mortgage Investment Trust

|

492.05M

|

11.31

|

0.88

|

3.38

|

18.25%

|

|

|

BlackRock

Kelso Capital

|

733.55M

|

13.38

|

1.06

|

5.03

|

10.51%

|

|

|

Harvest

Capital Credit

|

64.96M

|

3.95

|

0.72

|

10.65

|

8.82%

|

|

|

Solar

Senior Capital Ltd

|

210.59M

|

21.02

|

1.01

|

10.43

|

7.71%

|

|

|

Retail Properties of America, Inc.

|

3.30B

|

707.00

|

1.38

|

5.94

|

4.67%

|

|

|

Xcel

Energy Inc.

|

13.76B

|

13.96

|

1.48

|

1.29

|

4.05%

|

|

|

EastGroup

Properties Inc.

|

1.76B

|

58.65

|

3.59

|

9.21

|

3.68%

|

|

|

SmartPros

Ltd.

|

9.46M

|

-

|

1.00

|

0.58

|

2.97%

|

|

|

Safeway

Inc.

|

6.73B

|

14.54

|

2.12

|

0.16

|

2.84%

|

|

|

Goldcorp

Inc.

|

21.47B

|

-

|

1.03

|

4.40

|

2.27%

|

|

|

Avago

Technologies Limited

|

9.67B

|

18.13

|

3.55

|

4.03

|

2.15%

|

|

|

Altisource

Residential

|

385.95M

|

166.00

|

0.93

|

37.11

|

2.01%

|

|

|

U.S. Silica Holdings, Inc.

|

1.33B

|

17.05

|

4.97

|

2.73

|

1.99%

|

|

|

International

Game Technology

|

5.30B

|

18.14

|

4.11

|

2.26

|

1.97%

|

|

|

Total

System Services, Inc.

|

5.45B

|

23.29

|

3.59

|

2.88

|

1.37%

|

|

|

Synovus

Financial Corp.

|

2.78B

|

3.85

|

1.07

|

2.93

|

1.22%

|

|

|

Cognex

Corporation

|

2.68B

|

40.83

|

4.36

|

8.14

|

0.71%

|

|

|

Alliance Fiber Optic Products

|

327.04M

|

24.75

|

4.86

|

5.87

|

0.67%

|

10 Top High-Yield Dividend Stocks to Make Your Portfolio More Attractive

Dividend investing has become very popular

in today’s world. It often takes place when investors choose stocks to gain the

promised dividends from the companies underlying the stocks. Investors start

dividend investing because it allows them a source of income even at the time

when the stock market is struggling. It is one of the best ways to earn income

for retirement and also investors can protect themselves against the

volatility. If the value of the underlying stock drops dividends will still be

paid.

The stocks which show a higher yield tend

to offer greater returns over time than lower or no-yield

stocks. Here I am sharing the top 10 high dividend yield stocks:

TAL

Education Group (NYSE: XRS) –

Tal Education Group is operating as a

training institution in china. It provides training for primary school

mathematical Olympiad, English language, Chinese language, middle and high

school Mathematics, Physic, Chemistry and one-to-one personal training.

It has a market capitalization of 706.61

Million, EPS is 0.44, P/E ratio is 20.85 and the dividend yield is 21.93% at

the annual dividend payout of 0.50.

Box

Ships (NYSE: TEU) –

Box ships Inc. is an international shopping

company. It was formed by Paragon Shipping Inc., which is a global provider of

shipping transportation services. The company is engaged in the seaborne

transportation of containers worldwide.

Its market capitalization is 74.94 Million,

EPS is 0.76, P/E ratio is 6.07 and the dividend yield is 19.17 at the annual

dividend payout of 0.22.

Sandridge

Mississippian Trust I (NYSE: SDT) –

SandRidge Mississippian Trust I is a

statutory trust. It was created to acquire and hold Royalty Interests for the

benefit of Trust unit holders. The trust has a market capitalization of 383.32

Million, EPS is 2.99, P/E ratio is 4.58 and the dividend yield is 19.01% at the

annual dividend payout of 0.65.

Northern

Tier Energy (NYSE: NTI) –

Northern Tier Energy is an independent

downstream energy company. It has the refining, retail and pipeline operations

that serves PADD II region of the United States. Northern Tier Energy LP

operates in two business segments: the refining business and the retail

business.

It has a market capitalization of 2.98

Billion, EPS is 0.73, P/E ratio is 36.90 and the dividend yield is 18.81% at

the annual dividend payout of 1.27.

Portugal

Telecom (NYSE: PT) –

This is a holding and largest

telecommunication service providing company based in Portugal. It provides a

wide range of telecommunications and multimedia services, such as fixed line

and mobile telecommunication, pay television distribution, internet service

provider services and data transmission.

The company has a market capitalization of

4.48 billion, EPS is 0.32, P/E ratio is 16.51 and the dividend yield is

currently 15.57% at the annual dividend payout of 0.54.

AG

Mortgage Investment Trust (NYSE: MITT) –

This is a real estate investment trust that

is focusing on investing in acquiring and managing a diversified portfolio of

residential assets, other real estate-related securities and financial assets,

which it refers to as its target assets.

It has a market capitalization of 690.60

Million, EPS is 7.34, P/E ratio is 3.42 and the dividend yield is currently

12.72% at the annual dividend payout of 0.80.

Apollo

Residential Mortgage (NYSE: AMTG) –

Apollo Residential Mortgage Inc. is a real

estate investment trust that invests in finances. The company manages

residential mortgage-backed securities, residential mortgage loans and other

residential mortgage assets throughout the United States.

It has a market capitalization of 538.13

Million, EPS is 8.18, P/E ratio is 2.72 and the dividend yield is 12.60% at the

annual dividend payout of 0.70.

Ellington

Financial (NYSE: EFC) –

This is a financial company which

specializes in acquiring and managing mortgage-related assets and other types

of financial assets such as residential whole mortgage loans, asset-backed

securities, backed by consumer and commercial assets, non-mortgage-related

derivatives and real property.

It has a market capitalization of 508.87

Million, EPS is 5.44, P/E ratio is 4.59 and the dividend yield is 12.35% at the

annual dividend payout of 0.77.

Resource

Capital (NYSE: RSO) –

Resource Capital Corporation is also a

financial company. It focuses primarily on commercial real estate and

commercial finance. Its operations are conducted as a real estate investment

trust. The company has a market capitalization of 705.47 Million, EPS is 0.77,

P/E ratio is 8.46 and the current dividend yield is 12.25% at the annual

dividend payout of 0.20.

CYS

Investments (NYSE: CYS) –

CYS Investments, Inc. is financial company

that was created with the objectives of achieving consistent risk-adjusted

investment income. The company’s investment guidelines permit investments in

collateralized mortgage obligations that are issued by a government agency or

government entity.

It has a market capitalization of 2.12

Billion, EPS is 2.75, P/E ratio is 4.41 and the dividend yield is 10.57% at the

annual dividend payout of 0.32.

Summary

–

These are the top ten high dividend yield

stocks which can be a helpful in making a dividend portfolio more attractive.

You need to search carefully and should focus on all the points while selecting

these stocks.

For more information regarding high dividend yield stocks

data you can visit the site Dividend Investor.

18 Stocks With Very High Yields (+10%) And Earnings Growth

+10% yielding shares with strong earnings per

share growth originally published at "long-term-investments.blogspot.com" Some of my friends

search regular for stocks with very high yield. I don’t talk about high-yields,

stocks with yields between 5-10 percent. I mean stocks with annualized dividend

yields of more than 10 percent.

It sounds a bit unserious and I personally would

never buy such stocks but I can understand my friends because they have only a low

net worth and they try to boost their passive income from dividends.

Let me say one thing: It could not sustainable

for any kind of business to pay such a high amount of money to shareholders at

a normal valuation. Something must be wrong. But if find an attractive investment,

you can boost your dividend income and in ten years your investment paid-off.

Out there are 148 stocks with a yield over 10

percent. I’ve tried to figure out some interesting stocks.

These are my criteria:

- Dividend Yield above 10%

- Earnings per share growth for the next 5Y over

5%

- Market Capitalization over 300 million

Eighteen shares fulfilled these criteria. Seven

of them have a current buy or better recommendation.

The Best Stocks With Dividend Growth From Last Week (September 03 – September 09, 2012)

Stocks With Biggest Dividend

Hikes From Last Week by Dividend

Yield – Stock, Capital, Investment. Here is a

current sheet of companies that have announced a dividend increase within the

recent week. In total, 18 stocks and funds raised dividends of which 7 have a

dividend growth of more than 10 percent. The average dividend growth amounts to

51.02 percent. Exactly 11 stocks have a yield over three percent and two are

currently recommended to buy.

Subscribe to:

Posts (Atom)