Showing posts with label VET. Show all posts

Showing posts with label VET. Show all posts

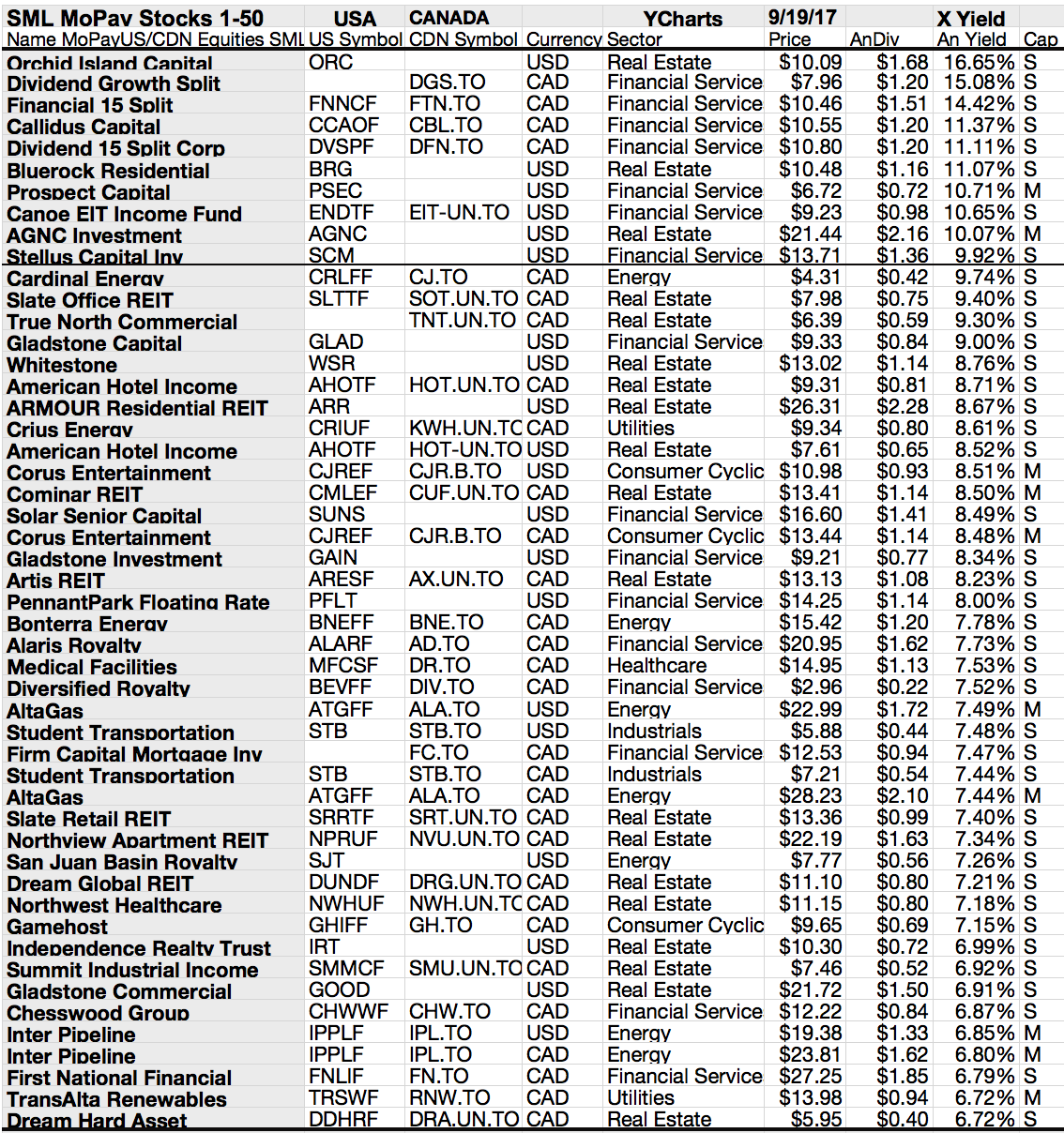

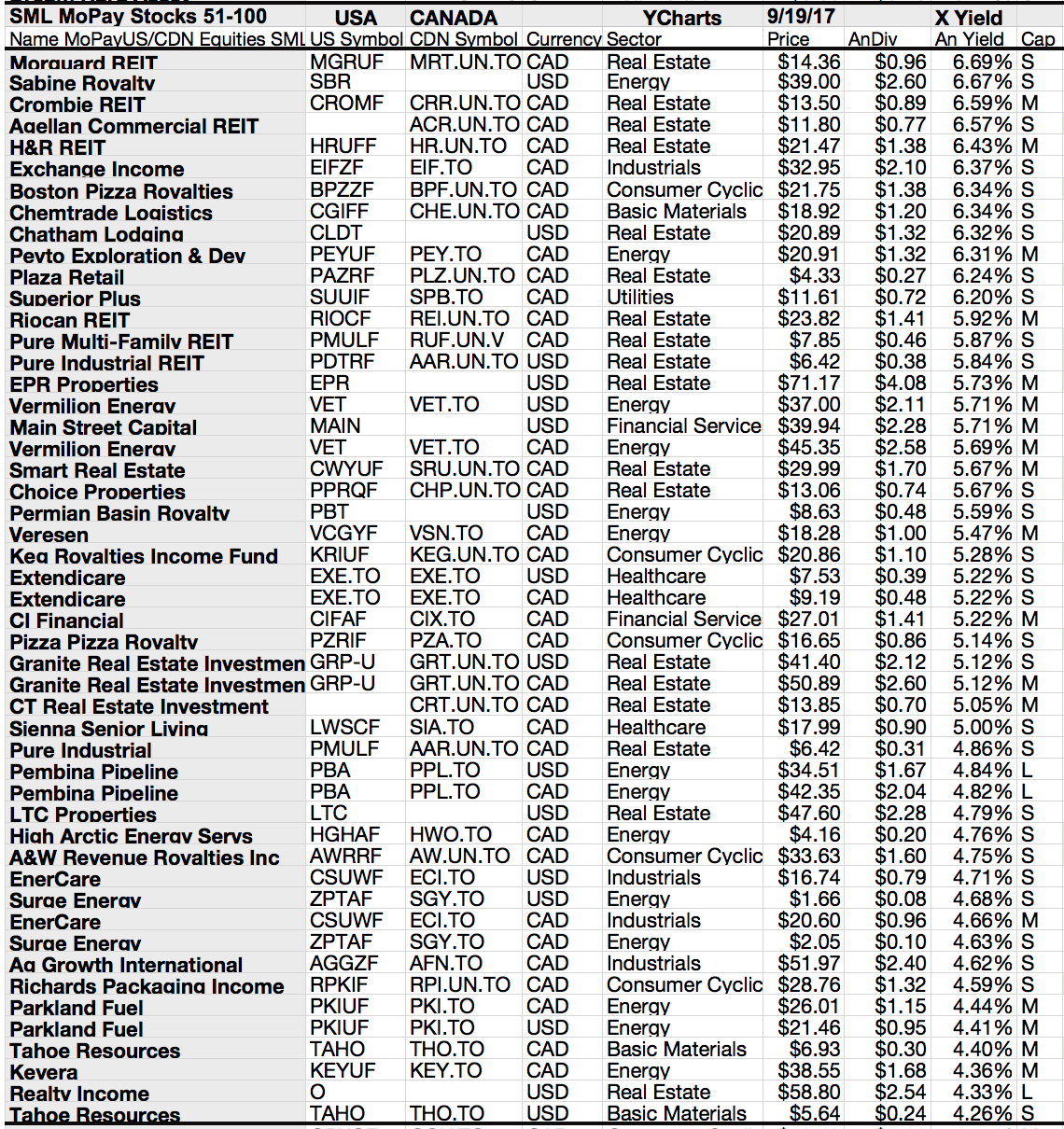

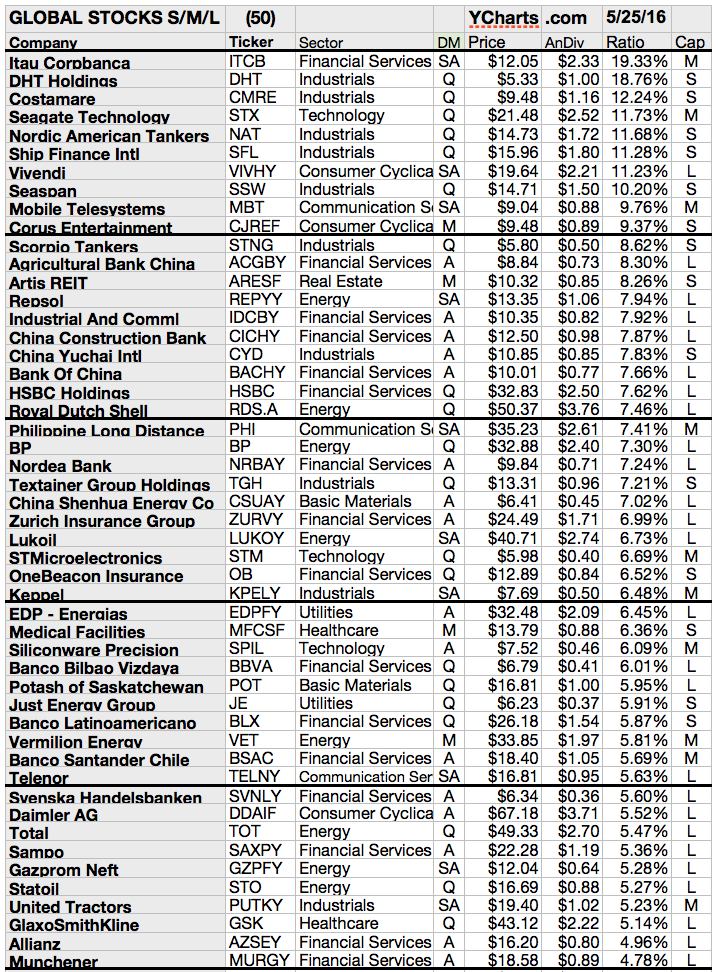

Global Dividend Dogs For May 2016

Please find attached the current list of the Dividends Dogs for May 2016. The list contain 50 stocks with yields between 4.78% and 19.33%.

What is a dividend dog?

The "dog" moniker is earned in three steps:

(1) any stock paying a reliable, repeating dividend

(2) whose price has fallen to a point where its yield (dividend/price)

(3) has grown higher than its peers (here in the Global collection) is tagged as a dividend dog.

|

| Global Dividend Dogs For May 2016, Source: Seeking Alpha |

Ex-Dividend Stocks: Best Dividend Paying Shares On July 29, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks July 29,

2013. In total, 52 stocks go ex

dividend - of which 33 yield more than 3 percent. The average yield amounts to 5.07%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Prospect

Capital Corporation

|

2.50B

|

10.93

|

0.98

|

4.88

|

11.96%

|

|

Kinder

Morgan Energy Partners

|

32.05B

|

39.84

|

3.60

|

3.39

|

6.10%

|

|

Entertainment

Properties Trust

|

2.43B

|

21.00

|

1.67

|

7.40

|

6.09%

|

|

Baytex

Energy Corp.

|

5.19B

|

23.66

|

4.25

|

5.59

|

5.93%

|

|

El Paso Pipeline Partners, L.P.

|

9.49B

|

20.33

|

874.40

|

6.31

|

5.67%

|

|

Omega

Healthcare Investors

|

3.75B

|

27.48

|

3.39

|

10.20

|

5.53%

|

|

National

Retail Properties, Inc.

|

4.10B

|

34.37

|

1.90

|

11.81

|

4.38%

|

|

Enterprise

Products Partners LP

|

55.54B

|

22.50

|

4.00

|

1.30

|

4.32%

|

|

Brookfield

Office Properties CA

|

2.36B

|

-

|

2.74

|

4.47

|

4.31%

|

|

Vermilion

Energy Inc.

|

5.42B

|

29.60

|

3.63

|

5.16

|

4.26%

|

|

Kinder

Morgan, Inc.

|

40.27B

|

41.80

|

2.95

|

3.25

|

3.91%

|

|

Western

Gas Partners LP

|

6.41B

|

87.36

|

3.79

|

7.39

|

3.53%

|

|

Alliant

Energy Corporation

|

5.93B

|

16.52

|

1.88

|

1.86

|

3.51%

|

|

NiSource

Inc.

|

9.78B

|

22.14

|

1.72

|

1.88

|

3.18%

|

|

Texas

Instruments Inc.

|

43.45B

|

24.53

|

3.97

|

3.45

|

2.85%

|

|

ConAgra

Foods, Inc.

|

15.48B

|

19.95

|

2.94

|

1.00

|

2.71%

|

|

Susquehanna

Bancshares, Inc.

|

2.57B

|

16.21

|

0.97

|

3.57

|

2.32%

|

|

Eaton

Vance Corp.

|

4.80B

|

23.27

|

7.37

|

3.81

|

1.95%

|

|

East

West Bancorp, Inc.

|

4.30B

|

15.72

|

1.91

|

4.20

|

1.92%

|

|

Western Gas Equity Partners, LP

|

8.73B

|

137.59

|

12.79

|

10.22

|

1.80%

|

Ex-Dividend Stocks: Best Dividend Paying Shares On May 29, 2013

The best yielding and biggest

ex-dividend stocks researched by ”long-term-investments.blogspot.com”. Dividend Investors

should have a quiet overview of stocks with upcoming ex dividend dates.

The ex dividend date is the

final date on which the new stock buyer couldn’t receive the next dividend. If

you like to receive the dividend, you need to buy the stock before the ex dividend

date. I made a little screen of the best yielding stocks with a higher

capitalization that have their ex date on the next trading day.

A full list of all stocks

with payment dates can be found here: Ex-Dividend Stocks May 29,

2013. In total, 110 stocks and

preferred shares go ex dividend - of which 37 yield more than 3 percent. The

average yield amounts to 4.06%.

Here is the sheet of the best yielding, higher

capitalized ex-dividend stocks:

Company

|

Ticker

|

Mcap

|

P/E

|

P/B

|

P/S

|

Yield

|

Prospect

Capital Corporation

|

2.63B

|

10.70

|

1.01

|

5.13

|

12.21%

|

|

TransAlta

Corp.

|

3.89B

|

-

|

1.32

|

1.87

|

7.68%

|

|

Baytex

Energy Corp.

|

4.78B

|

21.54

|

3.85

|

5.11

|

6.68%

|

|

Entertainment

Properties Trust

|

2.66B

|

22.89

|

1.83

|

8.10

|

5.59%

|

|

Lorillard,

Inc.

|

16.58B

|

14.11

|

-

|

2.48

|

5.01%

|

|

Vermilion

Energy Inc.

|

5.13B

|

27.99

|

3.43

|

4.88

|

4.66%

|

|

Integrys

Energy Group, Inc.

|

4.69B

|

12.54

|

1.44

|

1.01

|

4.59%

|

|

Brookfield Infrastructure Partners

|

8.04B

|

85.07

|

1.53

|

4.01

|

4.49%

|

|

Barrick

Gold Corporation

|

19.18B

|

-

|

0.85

|

1.34

|

4.18%

|

|

Piedmont Office Realty Trust

|

3.37B

|

71.82

|

1.29

|

8.25

|

3.98%

|

|

Brookfield

Office Properties Canada

|

2.62B

|

-

|

3.04

|

4.95

|

3.89%

|

|

Bank

of Hawaii Corporation

|

2.30B

|

14.57

|

2.24

|

5.61

|

3.51%

|

|

Northeast

Utilities

|

13.48B

|

20.60

|

1.42

|

1.88

|

3.43%

|

|

Cullen/Frost

Bankers, Inc.

|

3.86B

|

17.11

|

1.58

|

6.09

|

3.11%

|

|

Brookfield

Properties Corporation

|

9.15B

|

8.55

|

0.79

|

3.88

|

3.09%

|

|

Perusahaan

Perseroan

|

25.07B

|

18.16

|

4.16

|

3.18

|

3.06%

|

|

Harris

Corp.

|

5.52B

|

10.79

|

3.29

|

1.06

|

2.94%

|

|

AVX

Corp.

|

2.03B

|

-

|

1.03

|

1.43

|

2.91%

|

|

Time

Warner Cable Inc.

|

27.65B

|

3.80

|

4.01

|

1.02

|

2.74%

|

|

Corning

Inc.

|

23.10B

|

13.27

|

1.08

|

2.92

|

2.55%

|

Subscribe to:

Posts (Atom)